florida estate tax exemption 2021

A person may be eligible for this exemption if he or she meets the following requirements. Sep 08 2021 Federal Estate Taxes.

Awp Possible Estate Tax Law Changes What To Do Now Awp

Florida estate tax exemption 2021.

. Search local rates at TaxJars Sales Tax. If youre responsible for the estate of someone who died you may need to file an estate tax return. As there is no inheritance tax in Canada all income earned by the deceased is taxed on a final return.

Given that Florida has around a 2 average tax rate that means a homeowner with 500000 in portability will see a tax bill about 10000 a year lower than it would be without it. A nonprofit organization that is exempt from income tax under Section 501c3 or Section 501c19 of the Internal Revenue Code and holds a valid Maryland sales and use tax. Owns real estate and makes it his or her permanent residence Is age 65 or.

Download or Email DR-501 More Fillable Forms Register and Subscribe Now. The tax rate applicable to transfers above the exemption is currently 40. The Florida Department of Revenue is responsible for publishing the latest Florida State Tax.

Ad Valorem Tax Exemption Application and. Ad Valorem Tax Exemption Application and Return For Nonprofit Homes for the Aged R. While this isnt an income tax deduction this is a good opportunity to remind homeowners who purchased your home in 2021 that you must file for your Homestead Exemption by March 1.

November 28 2021 alison brie dave franco. The Tax Cuts and Jobs Act raised the lifetime gift and estate tax exemption to 117 million for 2021 and 1206 million in 2022. At the forefront of e-commerce business.

Ad Access Tax Forms. 1121 section 1961975 FS PDF 174 KB DR-504W. As mentioned the estate tax.

If the estate is worth less than 1000000 you dont need to file a return or pay an. Potential Tax Concerns for Inheritances. An individuals leftover estate tax exemption may be transferred to the surviving spouse after the first spouses death.

Exemption amount homestead total tax net tax feestax amount tax bill no date. Complete Edit or Print Tax Forms Instantly. Jabil was the second and received a 100000 exemption per year for.

Since Floridas estate tax was based solely on the federal credit estate tax was no longer due on estates of decedents that died on or after January 1 2005. Non-registered capital assets are considered to have been sold for fair market value. Arkansas - Grocery items are not tax exempt but food and food ingredients are taxed at a reduced Arkansas state rate of 15 any local rate.

The top estate tax rate is 12 percent and is capped at 15 million exemption threshold. But once you begin providing gifts worth more than the. The exemption amount will rise to 51 million in 2020 71 million in.

Estate Tax And Gift Tax Changes Coming In 2022 Karp Law Firm

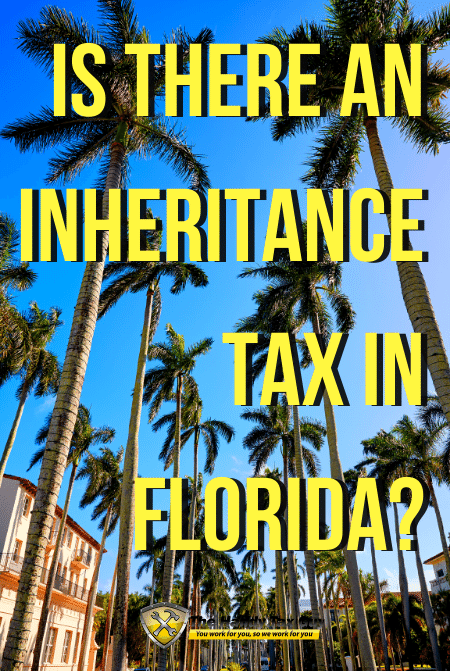

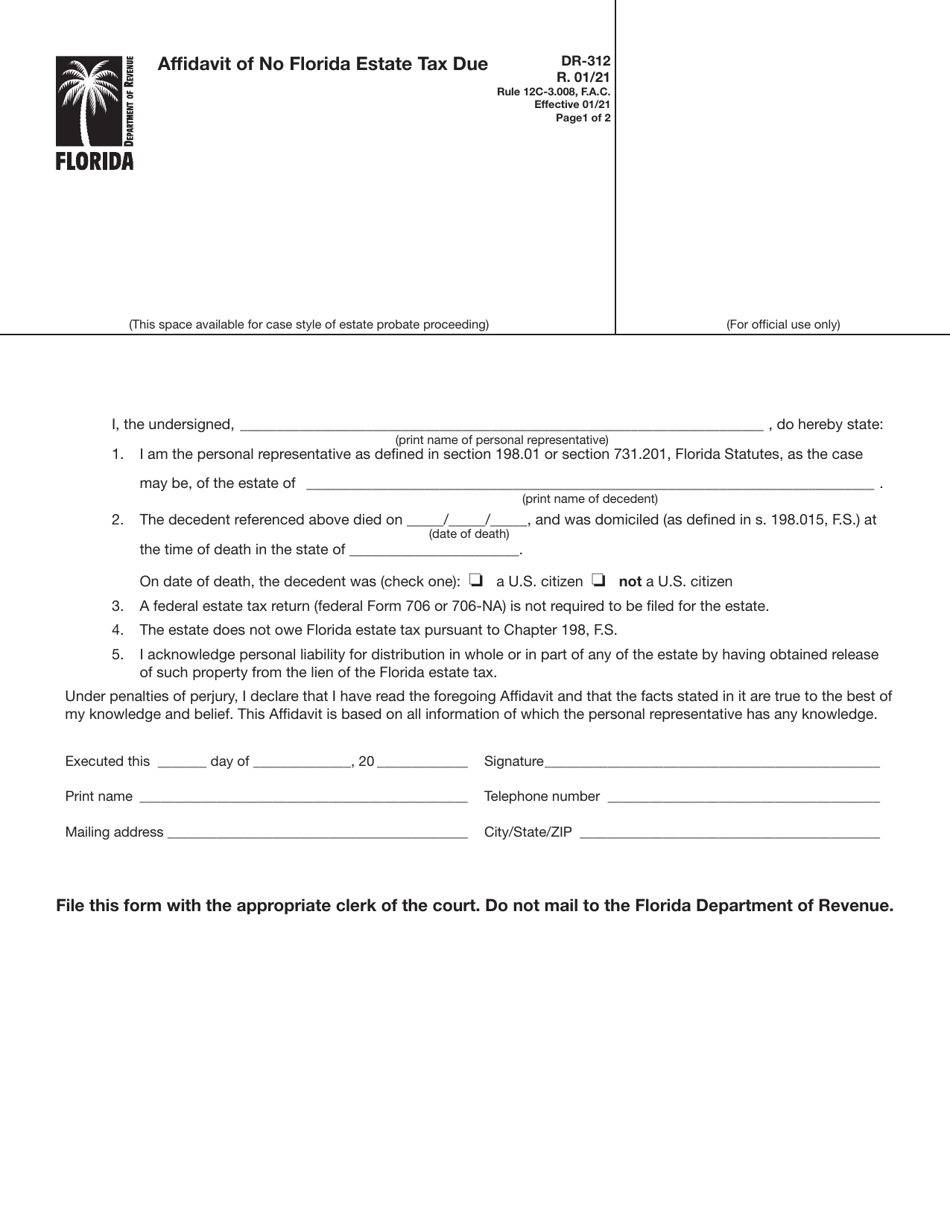

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

States With No Estate Tax Or Inheritance Tax Plan Where You Die

U S Estate Tax For Canadians Manulife Investment Management

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Is There An Inheritance Tax In Florida And Will You Have To Pay The Handy Tax Guy

Does Florida Have An Inheritance Tax Alper Law

Florida Property Tax H R Block

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

State Corporate Income Tax Rates And Brackets Tax Foundation

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Why Should Canadians Who Are Not Us Citizens Or Residents Be Concerned About Us Estate Tax Barclay Damon

How Is Tax Liability Calculated Common Tax Questions Answered

Florida Estate Tax Rules On Estate Inheritance Taxes

Does Florida Have An Inheritance Tax Alper Law

Estate Tax Landscape For 2021 And Beyond